What’s the best way to pay for college and how to split expenses when living with a roommate are two financial questions many college students face. New Mexico State University launched a new platform during the spring 2021 semester to help them make informed decisions.

The United States Department of Education is funding Educational Credit Management Corporation Project Success, a three-year project to retain and graduate students at NMSU. One of the project’s components is financial literacy. Students, faculty, staff and families can register for an account at https://ssc.nmsu.edu/ecmc-project-success/.

“The platform is designed to give students the opportunity to learn about different financial literacy topics regardless of their level in college,” said Tony Marin, assistant vice president of student affairs. “All the information is pertinent in trying to prepare students for their financial wellness while they are New Mexico State University Aggies and when they enter their careers upon graduation.”

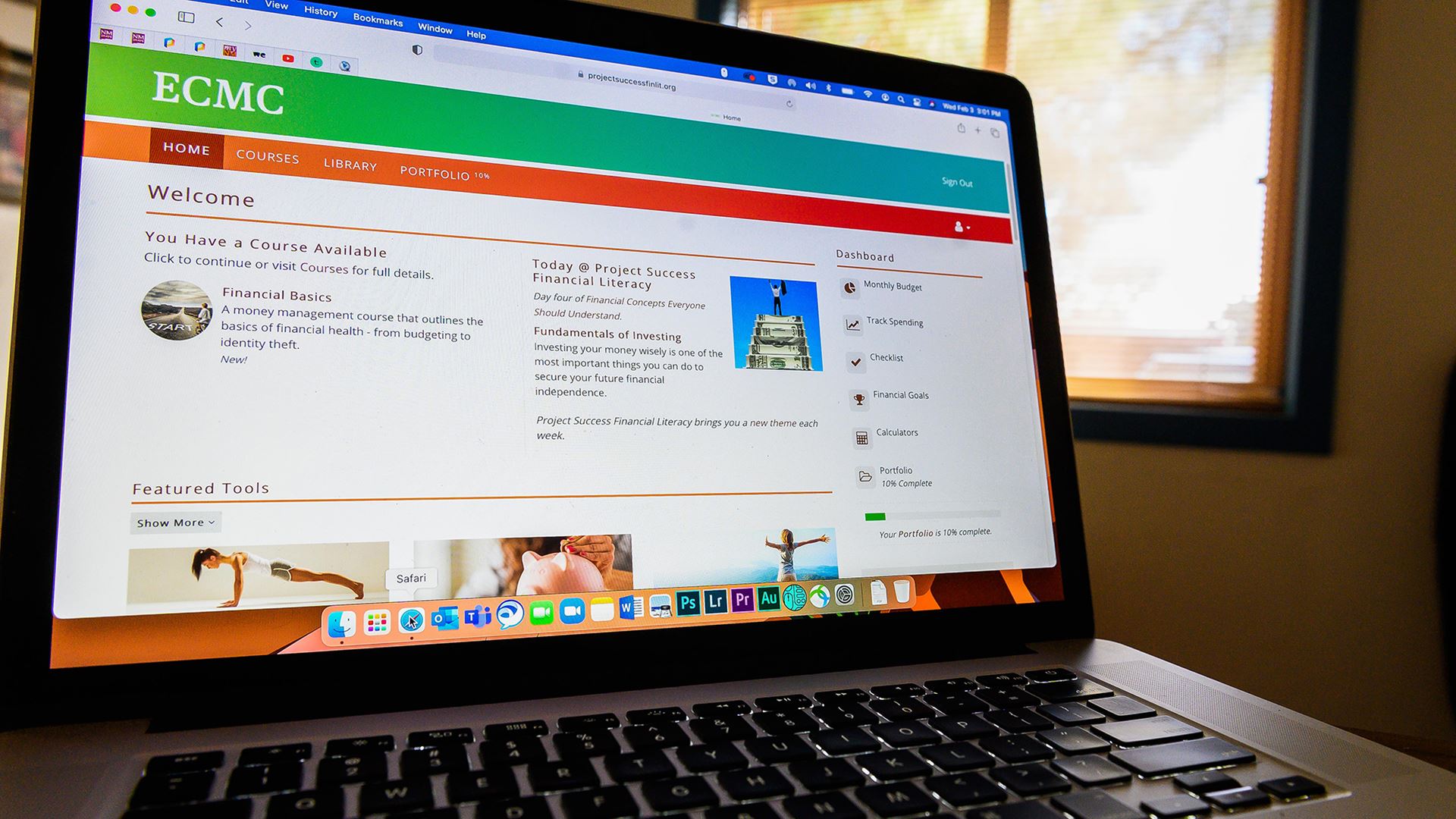

The online platform is an interactive tool that includes two- to five-minute videos, fact sheets, quizzes, course modules and more than 300 articles on topics such as budgeting basics, buying a car, managing credit, identify theft, paying for college, understanding insurance and career readiness.

“The topics are broad, but they also drill down to some of the challenges that come along with being a college student like managing money in order to reduce financial stress,” Marin said. “This comprehensive online financial literacy platform will allow students to access the resources they need now to prepare for their financial future.

“Our plan is to have all of our students create an account and utilize the information presented that is most important to them in order to build on their current financial literacy knowledge base,” he said.

Marin said he believes the student-centered platform offers a variety of resources for any type of learner and information for all levels of financial literacy understanding.

“Most college freshmen are learning how to manage their finances for first time. Recognizing this fact, universities such as NMSU are making an intentional effort to offer programming and the tools students need to enhance their financial literacy skillset,” Marin said. “One of the major challenges for students is financing their education. This tool will provide information about how to pay for college, suggest strategies on how to reduce student loan borrowing and how to budget properly for other non-tuition costs related to college. The platform also has information to assist students for preparing beyond college such as saving, purchasing a home, preparing for retirement and understanding taxes.”